Category Books

- Fiction Books & Literature

- Graphic Novels

- Horror

- Mystery & Crime

- Poetry

- Romance Books

- Science Fiction & Fantasy

- Thrillers

- Westerns

- Ages 0-2

- Ages 3-5

- Ages 6-8

- Ages 9-12

- Teens

- Children's Books

- African Americans

- Antiques & Collectibles

- Art, Architecture & Photography

- Bibles & Bible Studies

- Biography

- Business Books

- Christianity

- Computer Books & Technology Books

- Cookbooks, Food & Wine

- Crafts & Hobbies Books

- Education & Teaching

- Engineering

- Entertainment

- Foreign Languages

- Game Books

- Gay & Lesbian

- Health Books, Diet & Fitness Books

- History

- Home & Garden

- Humor Books

- Judaism & Judaica

- Law

- Medical Books

- New Age & Spirituality

- Nonfiction

- Parenting & Family

- Pets

- Philosophy

- Political Books & Current Events Books

- Psychology & Psychotherapy

- Reference

- Religion Books

- Science & Nature

- Self Improvement

- Sex & Relationships

- Social Sciences

- Sports & Adventure

- Study Guides & Test Prep

- Travel

- True Crime

- Weddings

- Women's Studies

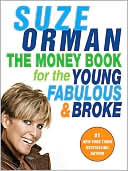

The Money Book for the Young, Fabulous and Broke » (Reprint)

Authors: Suze Orman

ISBN-13: 9781594482243, ISBN-10: 1594482241

Format: Paperback

Publisher: Penguin Group (USA)

Date Published: March 2007

Edition: Reprint

Author Biography: Suze Orman

Suze Orman is a two time emmy award winner and the author of six consecutive New York Times bestsellers: Women & Money, The 9 Steps to Financial Freedom; The Courage to Be Rich; The Road to Wealth; The Laws of Money, The Lessons of Life; and The Money Book for the Young, Fabulous & Broke.

Book Synopsis

A financial guide aimed squarely at "Generation Debt" - and their anxious parents - from the country's most trusted and dynamic source on money matters.

The Money Book for the Young, Fabulous & Broke is financial expert Suze Orman's answer to a generation's cry for help. They're called "Generation Debt" and "Generation Broke" by the media - people in their twenties and thirties who graduate college with a mountain of student loan debt and are stuck with one of the weakest job markets in recent history. The goals of their parents' generation - buy a house, support a family, send kids to college, retire in style - seem absurdly, depressingly out of reach. They live off their credit cards, may or may not have health insurance, and come up so far short at the end of the month that the idea of saving money is a joke. This generation has it tough, without a doubt, but they're also painfully aware of the urgent need to take matters into their own hands.

The Money Book was written to address the specific financial reality that faces young people today and offers a set of real, not impossible solutions to the problems at hand and the problems ahead. Concisely, pragmatically, and without a whiff of condescension, Suze Orman tells her young, fabulous & broke readers precisely what actions to take and why. Throughout these pages, there are icons that direct readers to a special YF&B domain on Suze's website that offers more specialized information, forms, and interactive tools that further customize the information in the book. Her advice at times bucks conventional wisdom (did she just say use your credit card?) and may even seem counter-intuitive (pay into a retirement fund even though your credit card debt is killing you?), but it's her honesty, understanding, and uncanny ability to anticipate the needs of her readers that has made her the most trusted financial expert of her day.

Over the course of ten chapters that can be consulted methodically, step-by-step or on a strictly need-to-know basis, Suze takes the reader past broke to a secure place where they'll never have to worry about revisiting broke again. And she begins the journey with a bit of overwhelmingly good news (yes, there really is good news): Young people have the greatest asset of all on their side -- time.

Publishers Weekly

With more than 6.5 million books in print (nearly three million of The 9 Steps to Financial Freedom alone), an eponymous CNBC show, contributing editorships at O: The Oprah Magazine and Costco Magazine and a biweekly Yahoo! column, Orman commands a great deal of economic bandwidth. This seventh book will be released with a PBS special (her fourth) pitched specifically to 20- and 30-somethings early in their working lives, who are, to put it nicely, having trouble negotiating a challenging economy: "Our starting point is that you are broke, by your or any definition." In the bright, clipped, supportive-but-not-mushy affirmative diction that dominates motivational business titles, Orman lays out a plan for maximizing the little that one has, focusing on ways to raise one's FICO score as a means of making more choices available. ("FICO" stands for the mysterious Fair Isaac Corporation-with whom Orman has an arrangement for her own FICOkit.) She runs through a plethora of money problems and what to do about them: credit card debt, student loans, mortgages (and advice on real estate), car payments, taxes, IRAs-almost anything one can think of that has to do with financial planning that can seem bewildering when presented by a salesperson, a direct mail solicitation or HR orientation. With its combination of specific solutions and deep knowledge of its target demographic's specific problems, this book positions itself perfectly and will see correspondingly strong sales among its coveted 18-34s. Agent, Amanda Urban at ICM. (Mar. 1) Copyright 2005 Reed Business Information.

Table of Contents

Subjects